-

Now Offering Limited Time Dental Promotions

At Bonham Dental Arts, we are committed to helping each patient receive the treatment they deserve.

Offers Expire: April 30th, 2024

Our Specialties

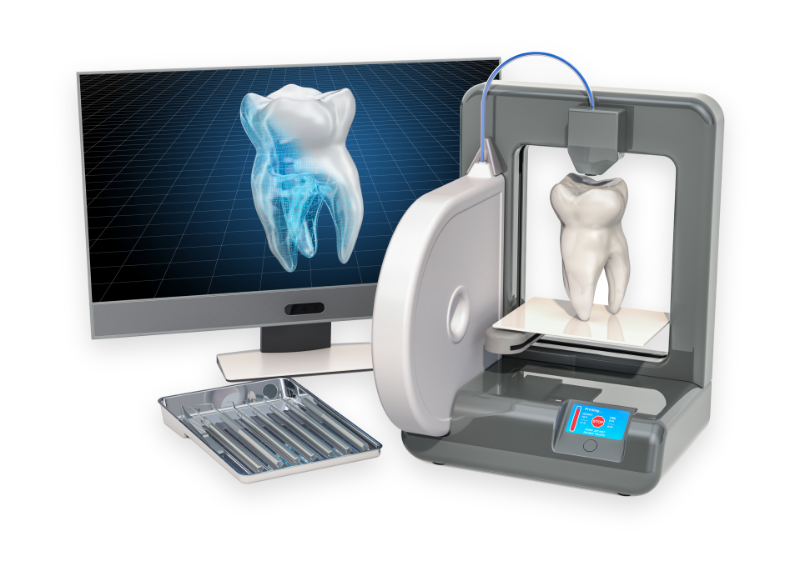

Advanced Dentistry at Bonham Dental Arts

Bonham Dental Arts knows that the best thing you can wear every day is a smile, and that’s why we use the most advanced technologies to boost the appearance of your smile. If your goal is beautiful, healthy smiles for you and your family, you have come to the right place.

What Our Patients Are Saying

"I have been a patient of Dr. Bonham since 1989 and recently moved to New York City. I flew in to Tampa today needing serious dental work and he did a superb job for 5 hours. The entire team at Bonham Dental Arts are simply the best!"

"Professional & excellent staff. Truly care and listen to their patients. The doctors are knowledgeable and have the health of the patient at the top of the list. After 30 years of being with them I can say without a doubt there are no better dentists anywhere."

"Best Dental visit I have ever had! I have extreme anxiety so I opted for the sedation. Dr. Carey Bonham was very understanding and told me he would make sure I would not have any pain and he was 100% correct. Great Dr. and staff!"

Redesigning Dental Care in Pinellas County

We have been in the business for decades, and believe firmly that our patients shouldn’t have to pay top-dollar for high-quality dental treatments. Our dental experts are always ready to perform affordable treatment that suits your needs, in a relaxing, spa-like environment.

Modern, Compassionate Dentistry

Our three dental professionals share the same last name, so there’s no denying that we know a thing or two about family! Dr. Carey, Dr. Amy, and Dr. Chris Bonham share a strong bond that they hope to extend to every patient that walks in the door. When we meet your family, we make sure you leave with happy, healthy smiles every time.

State-of-the-Art From Start to Finish

Our facility and technology are specially crafted and chosen to make your experience as easy as possible. From start to finish, your treatment will be based on excellence, whether you're seeking orthodontics, replacement for lost teeth, or anything in between!

Meet Our Team

Dr. Amy Bonham

Learn MoreDr. Chris Bonham

Learn MoreDr. Carey Bonham

Learn MoreDr. Jacob Labauve

Learn MoreDr. Vilson Merkaj

Learn More

Bring Your New Smile Home

With God at the foundation of all our work, we at Bonham Dental Arts commit ourselves to forming trusting relationships for life with our patients; young, old, and every age in between. From the moment you step into our office, you are treated like a member of our loving family and cared for just as we would care for our own. We have served the community for decades and aim to continue a legacy of excellence passed down from one generation to the next.

Experiencing A Dental Emergency? Call Us: (727) 581-1869

We’re available for emergency appointments!

Tour Our Office in Largo, FL

Take the TourSeminole

8300 113th St., Seminole, FL 33772

(727) 398-7473- Monday:

- 8:00AM - 5:00PM

- Tuesday:

- 8:00AM - 5:00PM

- Wednesday:

- 8:00AM - 5:00PM

- Thursday:

- 8:00AM - 5:00PM

Largo

12720 Ulmerton Rd., Largo, FL 33774

(727) 581-1869- Monday:

- 8:00AM - 5:00PM

- Tuesday:

- 8:00AM - 5:00PM

- Wednesday:

- 8:00AM - 5:00PM

- Thursday:

- 8:00AM - 5:00PM

- Friday:

- 8:00AM - 5:00PM